We are getting more comfortable in our living more like 1940. It takes time to do the research, a job of it's own, but necessary.

There is much math to do when figuring the budget and one must learn the charges on all of the household bills. We need to know the charge or fee of anything that flows to our home. On our electric bill we need to understand the kilowatt hour charge fee, and on the bill it should have that fee listed, possibly listed KWH. If it is not listed, a call to the electric department and someone should be able to give that information.

This is all important to know the water charge and sometimes there is a minimum fee for a certain amount of gallons even if we do not use those gallons. We have a sewer fee which is based on how much water we used. It is a higher fee leaving out than coming in to the house, so it is important that we understand that. There are so many added extra charges, taxes and fees and add up quickly. This makes me remember to mention that when we save money for an item that we need or want to purchase to figure in the tax of that item so we save for that as well.

My mother during the 1940's.

We are the ones responsible for our home and that includes purchasing groceries for the meals that we put on our table. When we set an amount to spend on groceries in our budget we need a way to stay in that budget so we meal plan.

Going to the store without a meal plan can be costly, and the cost of food and the menu plan is very important and something we can control because we do have choices if we sit down and plan and stick to the shopping list. For an example if we purchase a head of lettuce, we should have a use for that lettuce in our meal plans, same for a head of cabbage. We could have boiled cabbage, slaw, cabbage added to soup or stew. Cabbage goes well in a homemade taco and a raw cabbage leaf makes a wonderful and tasty wrap instead of bread.

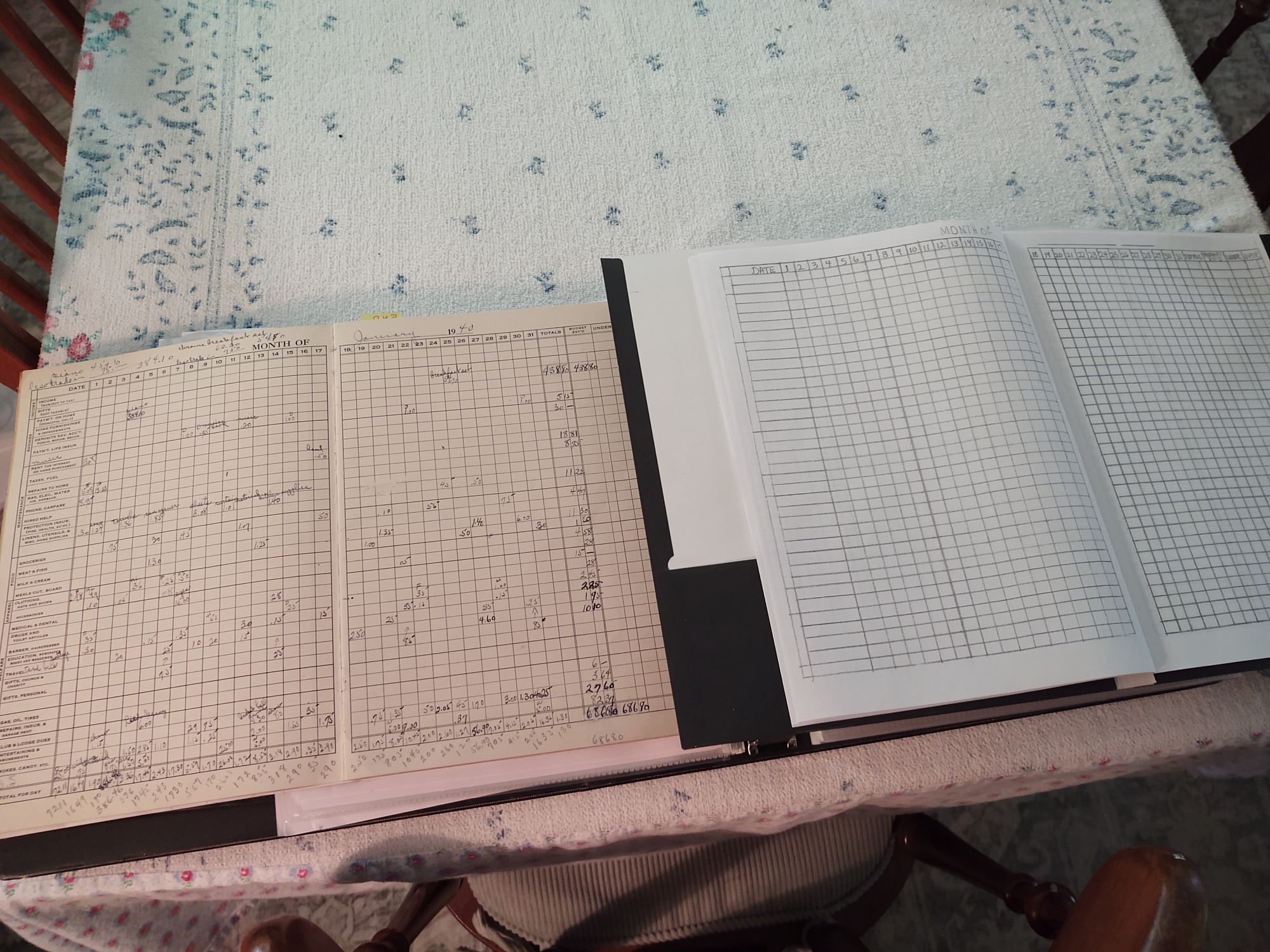

Photo above and to the left is the 1940 budget book from a family that lived in 1940 and the money they spent each day for the month. I talked about this budget book in my last post. Since my last post, to the right is the new budget book that I made.

After studying this 1940 book and all of their expenses I spent several days making my own budget book. I went to work drawing lines using a ruler and pen making my own budget book. I must say that I was wishing that I had a spreadsheet on my computer to make it easier but finally the job was done.

This budget book is a horizontal budget book where the 31 days go across the top of the page. The book explained that arranged in this manner, the chance of omitting the entries for a day is lessened. There is a row at the bottom of the page where each day is totaled and this gives us a total expenditure day by day which is helpful.

When as we spend money, we make an entry of what was spent in the column of that day under the category that it was spent. For groceries I put the total spent that day at the store and then record the items in ledger book that I use. I do this extra step so I can go back and look at the food prices and note the increase or decrease if and when they occur.

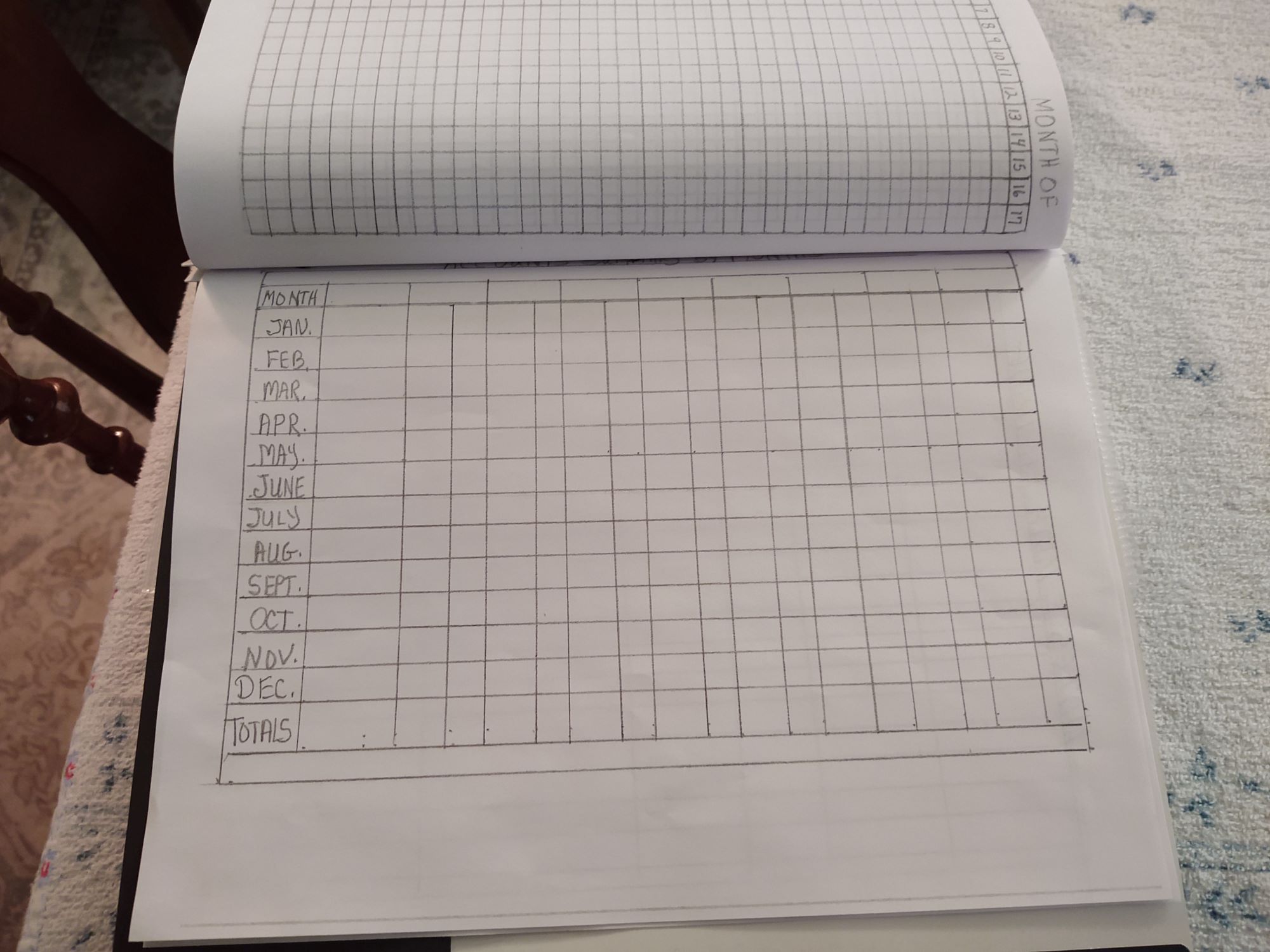

Photo above are forms in the back of the budget book which I also drew out. This form above is called Account Summery by Months. When I put it in the notebook it hid the title where I cannot see it so I need to write that lower.

This part here is long but I feel important to explain. Maybe get a cup of tea, coffee or something enjoyable :) Take a nap and come back if you get tired? When we get through this long post then maybe we can have more fun with the next one. :)

People here on this blog are from all over the world, we live in different places but many of us have much in common such as interest in living a simple life.

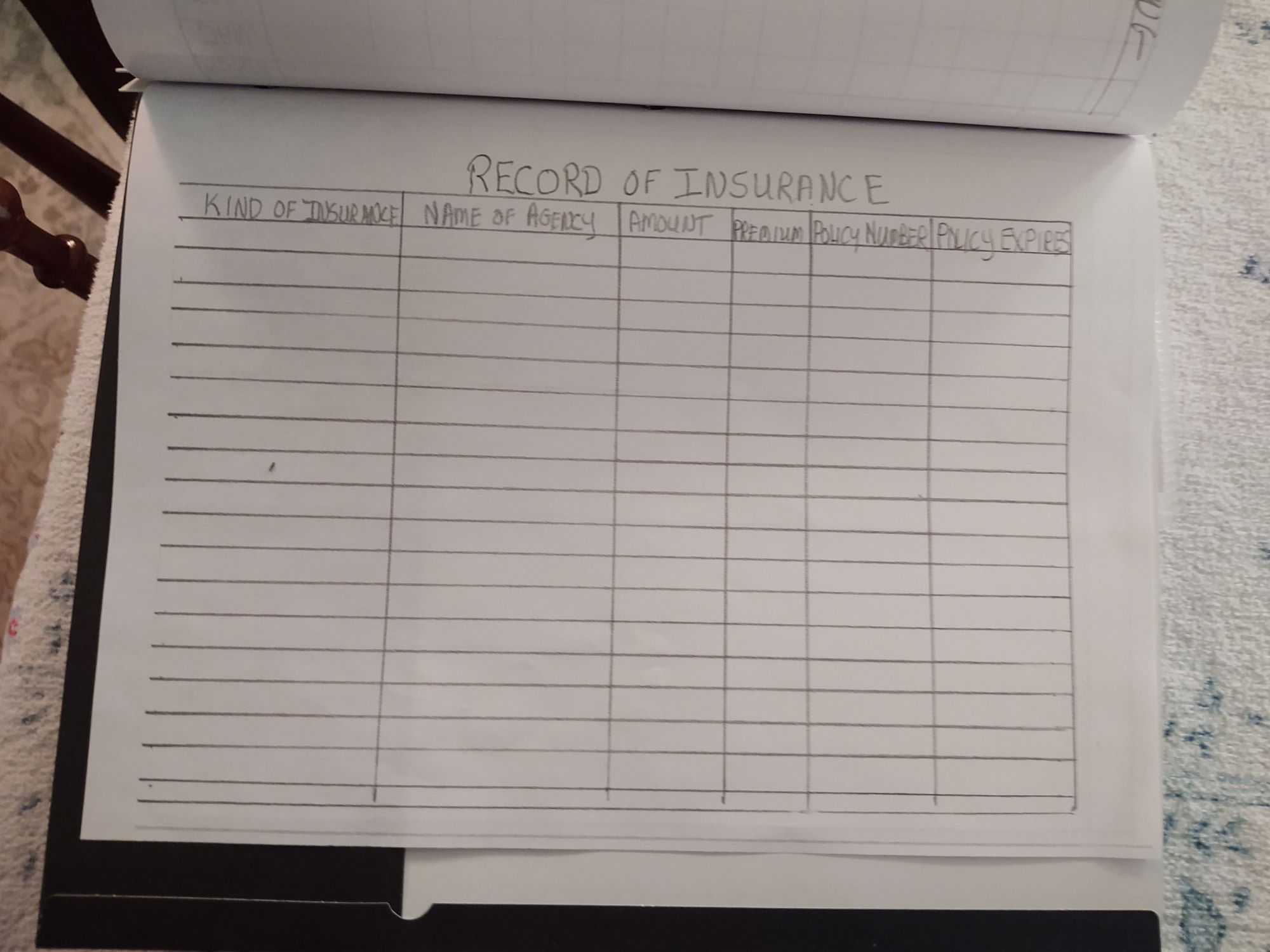

The record of insurance is a very sore subject for Charles and I because insurance is the most expensive part of all of our expenses that we have and very frustrating to pay for medical insurance and supplement and then still have to pay more medical fees when we go to the doctor.

Different health insurances, life insurance, car insurance, house insurance, it is almost unaffordable now since everything else has gone up. Insurance costs are what has kept Charles from retiring but next year he will retire and we will have to clamp down even more.

This next part is important.

Now some of our mistakes.... this is just so you know things to look out for.

By Charles continuing to work, we have no debt and managed to put extra in savings and also save three years ahead for our house taxes and our homeowners insurance should we have a difficult year or two or three at some point after Charles retires. We have reason to be cautious.

Our home is paid for but we still pay taxes for our home and insurance for our home, those are two payments are tough to pay living on social security and why it is so important to live frugal, know where every penny goes and save ahead of time for upcoming expenses.

We use the envelope system and then deposit that into a special savings account. All these years of blogging you can see we were trying to live frugal and keep expenses down. We needed to have some savings for retirement because Charles does not have a pension with his company or any military pay, he was in the Navy but not long term.

Some people may think when they have homeowners insurance that if something gets damaged the insurance company will come in and just fix it because you have been paying for insurance. But there are things you need to know. What is your deductible when something happens? How old is your roof when your roof was damaged? As with ours, our roof was depreciated so much that we were told that it was too old for insurance to pay to replace the roof after hurricane Michael. We had wind damage to our roof. We did not want to get a loan for a new roof because that would make the roof cost even more. We saved all we could and finally paid cash for a new roof the first part of 2023 and immediately started a new envelope for a new roof for years later.

But then a storm came, twisted off several limbs of a tree and the wind through the limbs through our new roof all the way through the decking boards and only 4 months after paying out all of that money for a new roof.

We paid cash for the repair because it was under the amount of the deductible for the new roof. Then this year of 2024, we had another storm with severe hail damage and insurance paid a good part of that to tear off half the roof on the house and helped to pay for the holy carport roof where the hail went through. So we had to deal with paying a deductible again. So we have been battling a lot of setbacks to achieving our goal to what we felt we needed for Charles to retire.

More lessons learned.

When Madge died, (Charles Mother) we knew that she wanted to be buried in the cemetery plot next to Charles father. The plot was paid for yet still the short viewing inside the funeral home and graveside service cost almost thirteen thousand dollars. We tried every way to get that price down and that was the least amount. Then when we ordered her cemetery marker the final cost to put Madge's body to rest and with a simple flat marker stone even though her plot was already paid for was right at $15,000.00. Yes, that was fifteen thousand dollars. There is much I want to say about this but will not because I do not know the costs to run a funeral home and keep a cemetery.

After we paid for Madge's expenses, we had the funeral home to figure out what our burial would cost. Many years ago Charles and I purchased two plots, two cement vaults, the opening and closing and paid for a stand up headstone and engraving. We made payments for many years until we got all of that paid for. We knew that we had never paid for the casket or graveside service and so when we went back to order the marker for Madge's grave, we asked what it would cost to pay for the rest of our funerals off. Since prices have increased so much they quoted us that it would cost Eight thousand dollars "each" to finish paying for the rest of these things that would have to be done. Remember that we paid for what we though was the most expensive part of a burial, the plots, the cement vaults, the opening and closing and the above the ground marker and the engraving of the stone. Now I am afraid to die, not because I am afraid to die but afraid of the cost to die.

This was the latter part of 2023 when we asked how much this would cost. At that time we could see in their books that it would cost around three thousand dollars each to be cremated. It is sad to me to think we paid all that money back when we were paying for a funeral, plots, headstone, cement vaults, opening and closing and a family member may have to make a decision to have us cremated because a casket and graveside service could be unaffordable even with all of that paid. I do not know what families do?

Now I don't know where you live wherever you are in this world but do these prices sound extreme or have you had this happen to you as well? Just curious. Between medical cost here in the United States and the cost to die, seems that they are trying to get all they can before we are completely done with.

I am only telling you these things because this needs to be planned for. This kind of money we have been spending set us back in retirement for Charles. Someone has to pay for the family members expenses when they die and you need to know that it is more expensive at need. In other words if it is not paid for before they die. Madge did have a five thousand dollar policy and that helped, I am sure she was thinking that would cover her funeral when she bought it. I would have too.

Now we have Madge's house that needs a lot of work. We have house insurance, taxes, electric, water, and garbage to pay there. You need to know that when a parent dies you are left with bills to pay. First you need a lawyer for Legal services, bills they still owed including medical and rescue charges. Remember I am not complaining, I want you to know that these things happen and so you look at the whole picture. Even if you sell, you need money until you do sell. We are not sure what we are going to do at this time because of the state that our country is in and we do not want to make any decisions like this the first year.

This is not our first death like this, we had my parents to care for and to also bury but that was 18 years ago and funerals were not as expensive as they are now. Things have changed and why I am explaining. There are more things such as if your family goes into a nursing home, they can come back and take your family members home for repayment for their care which could be the entire value of that home. These are things you need to find out about.

We must think about what we are leaving behind for our children should something happen to us.

Back to the very important budget book.

There is also a page that has columns to record what is purchased for clothing and accessories such as shoes, hats etc. The amount spent is listed in the budget page in the clothing line and then broken down in the back of the book as to what it was and who it was for. In the budget book they put an Initial to show who the expenditure was for... so say if I bought a skirt, I would write that amount in the daily record of spending and put my initial D and in the back of the book on a page under the column Donna I would write skirt, $24.98. It would not be necessary as to when because in the budget section it already shows when.

This study is making us get more organized in everything we do and is very good for our household. I feel we are getting a better handle on everything we do.

The last several post that I have done are showing details about the year 1940 that we cannot find easily so I have researched deeply to find budget books and occupations and salaries to get a sense of this time and as I showed in my last post. Details that you would need should you want to do this study and apply these things to your home or budget.

It is important that the day we pay those yearly bills we start saving to pay the next years bill. We divide that amount and break it down to how much we must save each payday. If something is $1,400.00 a year and we get paid once a month, we divide that by 12 and we see that we need to put aside $117.00 each payday to pay that bill when it is due again.

If someone is on Social Security and gets paid once a month, that $117.00 is a lot of money to set aside per month but must be done because that payment will come due no matter what. These kind of bills require us to place that money in a special account right away and it should not be touched until that bill is due and then keep putting it to the side again like before but adjust the amount if the payment if it has increased.

If we get paid twice a month we divide our figure of $1,400.00 by 24 and we see that we need to set aside $58.34 each payday. I am rounding off a bit for the cents.

If we get paid weekly we divide the fourteen hundred dollars by 48 and we will need to set aside $29.20 each payday for that yearly bill. We are taking it from the pay right away as we do other bills so we can always pay our bills on time. I would say divide by 52 weeks but paydays do not always come out exactly right. So however often you get paid, and know how many paychecks you will get each year, divide that into your bill payment to see how much money you set aside to have that $1,400.00 you need to pay that yearly bill.

It is best to first divide that yearly payment into twelve to see what it is you need to pay monthly and then divide it out after that. The budget is a monthly budget so you can consider this yearly expense a monthly expense even though you will not pay it for a year. You do this the same if you have a quarterly expense so it can go into your monthly budget.

I want to mention an email that I received from a long time blog reader of my blog. Something that Ann said in her email really spoke to me. She was talking about how she manages her money and that she has used the envelope system since when she married in the early 1960's. Ann's system saves her from worries about bills arriving, we all need that.

She is using a very similar budget like I am showing other than the months go across the top and each expense down the left side such as food, gas, insurance etc.

She described her budget book and it would look different than mine but still comes out with the same information of expenses. Ann said that she is very specific so she knows each month exactly what was spent and what remains for each expense.

Ann went on to explain, I know my yearly income, split that into 12 months, that is how I know how much is left at a months end, in good years, after totaling all at December 30, I hope to have a surplus, that is my Profit... just as if I am a small company. It is an easy system and has served me well for all these years.

Besides that good information, what stood out the most of all to me, was when she said, .... "too few people think a budget is Not Spending but if one treats a home as a business, it only makes sense to look for a profit at years end".

I could not have said this any better and never thought to explain it this way. Yes Ann, and thank you because that helped me get in my head now that I am running a home business and the business is my home. We all have ways of budgeting and running a home but especially in todays time and the way it is, yes, we do need to think of it like a business and we sure do not want our business to fail. I hope this helps you all as much as it has helped me.

I can say from our personal experience that the envelope system and the budget is very empowering!

The envelope system is a savings system, it is a way to divide that income paycheck. This is an old system that people have used for many years and even before 1940. It has worked well and for some reason it holds us accountable.

Times are changing, the banks are changing, the way people are banking is changing. Charles and I have been sticking to our old system as long as we can but we feel the pressure from the banks and we see in the news that some are stores are going cashless and banks are trying to get us to do everything online. We do not want to! But we realize we will be pushed into this at some point in time.

We have worked out a system for us to continue to have the envelope system without changing completely so we can be ready when we are forced to go cashless and online banking. We realize that most all of our family, friends and neighbors now does online banking and we are part of the few holding on. There is nothing wrong with either way other than they should not take our choice away. I will not be surprised when they lock the bank doors for good and there is no actual bank.

The main thing here is that we put the money aside for expenses, unexpected repairs and wants, in an very organized way.

To get out of debt, is doing the envelope system. Charles and I were in debt before and we know what that feels like and the envelope system is what got us out of debt. When you stand at a checkout counter at a grocery store and you pay cash, you see that money going away and most importantly we see what we have left. We are living in a time where people never see their cash spent. To me this is not a good thing unless we are all very self disciplined, good in math and keep very good records.

Get out of debt so you don't have to pull that ball and chain around anymore. Some people get full of guilt or blame someone else when they find themselves in a financial crisis. We have to forgive ourselves for our mistakes in life. So we need to work on that and forgive ourselves for our financial mistakes so we can move one and get out of debt. It is difficult to look at the numbers when you are in debt but once again if you have to do it over again, forgive yourself and move on, it is going to be okay. It will start out slow but then a few months will go by and then some more and before you know it a year has gone by. Then some more months and so on. That time is going to go by anyway, might as well be on the right path.

1940 is a great year other than the war. Let's keep moving on in the study.

The forum is up there and if you would like to comment or have questions please feel free to post. I am so happy how everyone has been so helpful in the forum and great conversations and sharing with each other. Have you changed in anyway since the 1940 study started? Do you know some unexpected expenses that others should know about?

Grandma Donna